Imagine a world where your money works harder than you do. Sounds dreamy, right? Well, welcome to the world of making passive income, where your cash takes on a life of its own, multiplying while you binge-watch your favourite series on Netflix. (House Of The Dragon, anyone?)

For the unaware, passive income is money earned with minimal effort. Unlike active income, where you trade hours for rupees, earning passive income involves multiple money streams that continue to flow even when you’re not actively involved.

Importance of Earning Passive Income

Simply put, we like to think of passive income and, more specifically, different passive income ideas as your golden ticket to financial freedom and stability. It’s about creating additional revenue streams that can help you achieve independence, providing more flexibility and time to do the things you love.

To be more precise, the benefits of these passive income ideas can be listed as follows:

1) Additional Revenue Streams: Think of earning passive income as empowering yourself with multiple faucets in your financial house. When one runs dry, others keep the water flowing, giving you a sense of control over your financial future.

2) Financial Security and Independence: With steady online passive income, you can bid farewell to stressing about unexpected expenses. You’ll have the peace of mind that comes with financial security and independence, making you more resilient against financial hiccups.

3) Flexibility and Time Savings: The best passive income ideas will liberate you from the constraints of a traditional job, allowing you to spend more time on hobbies, travel, or simply enjoy life, while your passive income works tirelessly in the background.

So, How Do You Make Passive Income?

Believe it or not, there are several passive money ideas out there. Having said that, the ones that are most likely to give you the return on investment that you’re looking for are as follows:

Section 1: Passive Income Investments

1. Divident Stocks

Source: Google

When it comes to passive income ideas, dividend stocks are like the golden geese of the stock market. These stocks pay a portion of their earnings back to shareholders as dividends. It’s like getting a bonus check for simply holding onto your shares.

Of course, getting the most bang for your buck really depends on your ability to select high-yield dividend stocks.

How Do You Do This?

Simple!

Choosing high-yield dividend stocks involves looking for companies with a consistent history of paying dividends. Keep an eye on the dividend yield and the payout ratio, which is the proportion of earnings a company pays out as dividends and overall financial health.

Companies like Coca-Cola and Johnson & Johnson are often favourites for dividend investors. This is simply because they are always in the green, financially speaking. Want to know how they do this? We highly recommend checking out the marketing mix of Coca-Cola.

Benefits and Potential Risks

Benefits: The benefits of this idea of passive income include regular income and potential for capital appreciation, and often, these companies are well-established with stable cash flows.

Risks: Dividend cuts during tough economic times and stock price volatility.

2. Dividend Exchange-Traded Funds (ETFs)

ETFs are investment funds traded on stock exchanges, much like stocks. A dividend ETF invests in a basket of dividend-paying stocks, providing diversification and regular income.

In terms of the advantages of this passive income investment, ETFs offer a diversified approach to investing in dividends without picking individual stocks. They typically have lower fees and provide steady income.

Some popular dividend ETFs include the Vanguard Dividend Appreciation ETF (VIG) and the SPDR S&P Dividend ETF (SDY). These ETFs hold a variety of dividend-paying solid companies.

3. Bonds

Source: Google

Bonds are loans you give governments or corporations, which they pay back with interest. If you’re looking for a low-risk way to make passive income, bonds and, by extension, bond funds are where your search ends.

The different types of bonds are as follows:

- Government Bonds: Issued by national governments; considered very safe.

- Corporate Bonds: Issued by companies; higher risk and higher returns.

- Municipal Bonds: Issued by states or municipalities; often tax-exempt.

Benefits and Risk Considerations

- Benefits: What makes this one of the best passive income ideas is the fact that it’s accompanied by steady income and a lower risk compared to stocks and diversification.

- Risks: On the other hand, the biggest con of this passive money idea is the fact that it comes with an interest rate risk, credit risk, and the potential for lower returns compared to stocks.

4. Real Estate Investment Trusts (REITs)

Source: Google

Searching high and low for passive residual income ideas? REITs are where it’s at! In simple terms, REITs are companies that own, operate or finance income-producing real estate. They must pay at least 90% of their taxable income as dividends.

REITs earn income from renting out properties and pay dividends to shareholders from this rental income. It’s like owning real estate without the hassle of being a landlord. Now, if that doesn’t make it a passive residual income idea worth pursuing, we don’t know what will!

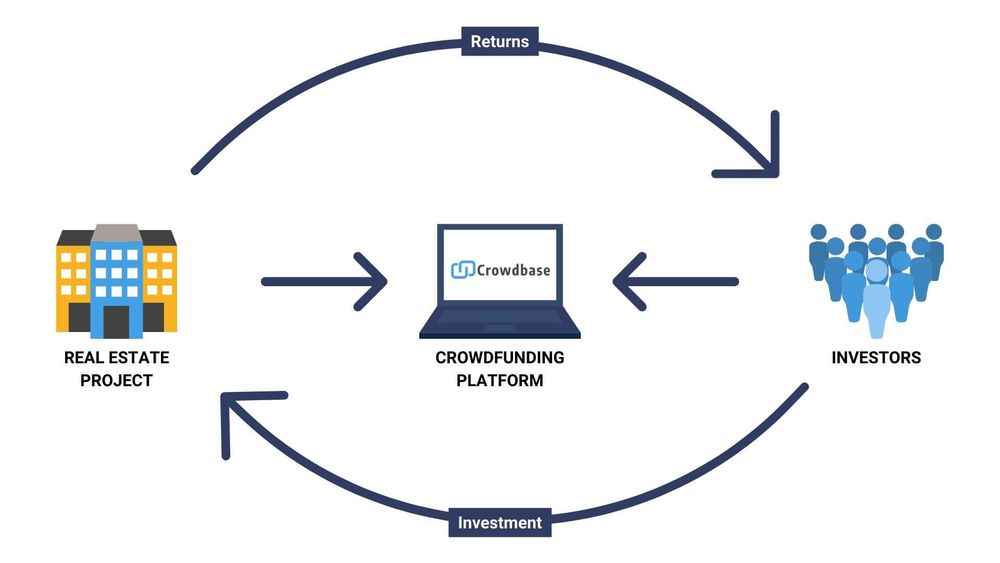

5. Real Estate Crowdfunding

Source: Google

Next on our list of passive residual income ideas is real estate crowdfunding. Platforms like Fundrise and RealtyMogul offer opportunities to invest in various properties.

Benefits and Risks Involved

- Benefits: Access to real estate investments with lower capital, diversification, and the potential for high returns.

- Risks: Illiquidity, which means your investment may not be easily converted into cash, platform risk, which refers to the risk of the crowdfunding platform going out of business, and the inherent risks of real estate investments such as market fluctuations and property damage.

Section 2: Digital and Online Passive Income Ideas

While these ideas can help you make passive income in the long run, they do require some initial work on your part.

6. Affiliate Marketing

Source: Google

Want to know a little secret? When people ask us, ‘How to make passive income?’, our first recommendation is to try their hand at affiliate marketing typically. Simply put, affiliate marketing is like being a matchmaker but for products. You get a commission by promoting products and getting customers to buy them.

Steps to Start Affiliate Marketing

- Choose a Niche: The first step to earning passive income here is to pick something you’re passionate about, and that has a large potential customer base, like gourmet cat food or vintage video games.

- Join Affiliate Programmes: Next, sign up for programmes like Amazon Associates or ShareASale.

- Create Content: Write blogs, shoot videos, or post on social media to promote your chosen products.

- Include Affiliate Links: Sprinkle these links throughout your content like magical fairy dust, and that’s it; you’ve officially got a way to make passive income.

Of course, affiliate marketing isn’t as easy as one might think. To learn more about this field and how to master it, we highly recommend checking out our digital marketing masters courses.

Tips for Maximising Earnings

- Build Trust: Your audience needs to trust you’re suggestions, so don’t endorse something you don’t personally believe in.

- SEO Magic: Optimise your content to appear in search engine results. If you’re new to the world of SEO, our digital marketing course is guaranteed to teach you everything you need to know.

- Track Performance: Use analytics to see which products are hitting the jackpot.

7. Digital Product Sales

Fun fact: Selling digital products is one of the best passive income ideas. These include:

- E-books: This passive income idea involves writing about your expertise or that wild adventure in the Amazon.

- Online Courses: Another idea of passive income is that you can teach something you’re good at here. This includes anything from yoga to advanced basket weaving. You can refer to our courses on digital marketing online for an example of what a good online programme is supposed to look like.

- Software: Create apps or tools that people need.

How to Create and Sell Digital Products

Mentioned below is a brief method on how to execute this passive income idea:

Step #1: Identify Market Needs

The first step in making your ideas of passive income a reality is to find out what people are desperately Googling at 3 AM.

Step #2: Create the Product

Use tools like Canva for e-books or Teachable for courses to create your product.

Step #3: Sell on Platforms

Use websites like Gumroad, Udemy, or your own website to sell your products and make p

Of course, creating the product is only half the task… You need to be able to market the same as well. To learn the best way to do this, we highly recommend checking out our online digital marketing course.

8. YouTube and Content Creation

Source: Google

YouTube isn’t just for cat videos anymore. It’s a goldmine for creators who can gather a large following and monetise through ads, sponsorships, and merchandise. In other words, it’s currently one of the best passive income ideas out there.

How to Monetise a YouTube Channel

Step #1: Create a Channel

The first step to executing this passive income idea is setting up your profile and choosing a niche. This can be anything from a channel on race cars to a channel on the latest information in the field of digital marketing. Our free instagram marketing course and free top paying skills course are great examples of channel content.

Step #2: Build an Audience

Consistently upload quality content.

Step #3: Join the YouTube Partner Programme

This will help you start earning from ads.

How to Grow Your Audience and Increase Revenue

- Engage With Your Audience: Respond to comments and create community posts.

- Collaborate With Other Creators: Leverage each other’s audiences.

- Optimise Video Titles and Descriptions: Use keywords to improve searchability.

Want to learn the secret to growing your audience? Our digital marketing courses in thane and digital marketing courses in gurgaon are guaranteed to help.

9. Blogging

Source: Google

In our opinion, blogging is an excellent idea of passive income because it can be your digital diary that pays. With the right strategies, your blog can raise money through ads, sponsored posts, and affiliate links.

Monetisation Strategies

Earning passive income through blogging is easy… Provided you have the right monetisation strategies in place.

- Ads: Use Google AdSense to display ads on your blog.

- Sponsored Content: Partner with brands to write about their products.

- Affiliate Links: Earn commissions by promoting products.

How to Build a Successful Blog

To ensure that you earn the maximum amount of money from your passive money idea, we highly recommend doing the following:

- Post Regularly: Keep updating your blog.

- Engaging Content: Write posts that are informative and entertaining.

- SEO: Optimise your posts for search engines to attract organic traffic.

Searching for references of what a good blog should look like? Check out our digital marketing blogs and digital marketing case studies.

10. Dropshipping

Source: Google

Dropshipping is like running an online store without ever touching the products. You sell items, and a third party handles inventory and shipping. Considering this, it’s really no surprise that everyone and their neighbour is jumping on this passive income idea.

How to Start a Dropshipping Business

To ensure that this idea of passive income is a success, we highly recommend following the steps mentioned below:

Step #1: Choose a Niche

Find a specific market, like eco-friendly gadgets.

Step #2: Set up Your Store

Use platforms like Shopify or WooCommerce.

Step #3: Find Suppliers

Partner with reliable suppliers who handle the shipping.

Want to know how to market your products? We highly recommend checking out our digital marketing courses in surat.

That being said, we understand that not everyone has the time to attend a digital marketing course. And if you agree, we suggest going through the marketing strategy of ross dress for less and the marketing mix of jollibee. These companies have unique marketing strategies that you can apply to your own brand.

Section 3: Finance and Savings-Based Passive Income Ideas

11. High-Yield Savings Accounts

Source: Google

Another way to make passive income is through high-yield savings accounts.

How to Choose the Best High-Yield Savings Account

To ensure you get the best returns from this passive money idea, make sure that you consider the following:

- Interest Rates: Look for the highest rates.

- Fees: Avoid accounts with monthly fees.

- Accessibility: Ensure easy access to your money

12. Certificates of Deposit (CDs)

A Certificate of Deposit (CD) is a savings account with a fixed interest rate and term. It’s like locking your money in a time capsule that earns interest. Now, that’s what we call an excellent idea of passive income!

Types of CDs and Their Terms

- Traditional CDs: Fixed rates and terms from 3 months to 5 years.

- Jumbo CDs: Higher minimum deposits but better rates.

- Bump-Up CDs: Allow you to increase your rate once during the term.

13. Peer-to-Peer Lending

Source: Google

The next one on our list of ways to make passive income is peer-to-peer lending, which connects borrowers with investors through online platforms like LendingClub or Prosper.

How to Invest in Peer-to-Peer Lending

- Choose a Platform: Sign up on a trusted site.

- Diversify Investments: Spread your money across multiple loans.

- Monitor Returns: Keep track of your investments and returns.

Section 4: Unique Passive Income Ideas

14. Advertising on Your Car

Source: Google

Imagine turning your car into a money-making machine by wrapping it in advertisements. Car advertising is as simple as it sounds: Companies pay you to transform your vehicle into a mobile billboard. As you go about your daily routine, your car’s ad wrap grabs eyeballs and generates impressions for the advertiser. Needless to say, this makes it a great passive income idea.

How to Start Earning from Car Advertising

Step #1: Sign Up with a Reputable Company

Look for companies that offer car advertising opportunities, such as Wrapify, Carvertise, or Free Car Media.

Step #2: Get Your Car Wrapped

Once accepted, the company will wrap your car with a high-quality vinyl advertisement. It’s painless and won’t damage your car.

Step #3: Drive Around

Yes, it’s that easy. Just continue your daily driving habits, and you’ll start earning money based on the mileage and areas you cover.

15. Vending Machines

Source: Google

Vending machines are not just for grabbing a quick snack anymore—they’re also great for earning passive income.

Final Thoughts

Whether you dive into affiliate marketing, sell digital products, or invest in high-yield savings accounts, there’s a passive income stream out there for you. So take the plunge and start building your financial future today.

Happy earning!

FAQs About Passive Income Ideas

Q1. What is passive income?

Passive income is earnings derived from activities or investments in which the earner is not actively involved. This includes revenue streams such as rental income, dividends from stocks, royalties from intellectual property, and income from online businesses that require minimal daily effort.

Q2. What are some popular passive income ideas?

- Dividend Stocks: Investing in stocks that pay regular dividends

- Real Estate: Renting out properties or investing in Real Estate Investment Trusts (REITs)

- Peer-to-Peer Lending: Earning interest by lending money through online platforms

- Affiliate Marketing: Promoting products and earning commissions on sales

- Digital Products: Selling e-books, online courses, or software

- Blogging: Monetising a blog through ads, sponsorships, and affiliate links

- YouTube Channel: Earning revenue from ads, sponsorships, and merchandise

Q3. How can I start earning passive income with little to no money?

- Affiliate Marketing: Start a blog or social media channel and promote products to earn commissions.

- YouTube Channel: Create content and monetise it with ads and sponsorships

- Digital Products: Write an e-book or create an online course on a topic you know well and sell it online

Q4. Is passive income really passive?

- Creating Digital Products: This requires initial time and effort but can generate ongoing sales

- Real Estate: Requires finding and managing properties, dealing with tenants, and maintaining the property

- Dividend Stocks: Requires initial capital investment and ongoing portfolio management

Q5. What are the tax implications of passive income?

- Dividends: Typically taxed at capital gains rates, which may be lower than ordinary income tax rates

- Rental Income: Subject to income tax, you can deduct expenses like mortgage interest, property taxes, and maintenance

- Royalties and Affiliate Income: Generally taxed as ordinary income. It's essential to consult with a tax professional to understand specific tax obligations and benefits related to your passive income sources

Q6. How much money can I make from passive income streams?

- Dividend Stocks: A well-diversified portfolio yields 2-5 % annually

- Real Estate: Depending on location and property type, rental yields can range from 4-10%

- Affiliate Marketing: Successful marketers can earn a few hundred to several thousand dollars monthly

- Digital Products: Potentially unlimited, depending on product popularity and marketing efforts

Q7. What are the risks associated with passive income investments?

- Stock Market Volatility: Dividend stocks can decrease in value, and dividends can be cut

- Real Estate Market Fluctuations: Property values can fall, and rental income can be inconsistent

- Peer-to-Peer Lending Defaults: Borrowers may default, leading to potential losses

- Digital Products: Sales can fluctuate based on market demand and competition. Diversifying your income streams and conducting thorough research to mitigate these risks is crucial

0 Comments